Ever paid $10 for your blood pressure pill, only to find out you still owe $1,500 toward your deductible? You’re not alone. Thousands of people think their generic copays are chipping away at their deductible - but they’re not. Here’s what actually happens when you pay for prescriptions under a health insurance plan, and why it matters more than you realize.

What an out-of-pocket maximum really means

Your out-of-pocket maximum is the most you’ll pay for covered care in a year. After you hit that number, your insurance pays 100% of allowed costs for the rest of the year. For 2025, the federal limit is $9,200 for an individual and $18,400 for a family. These numbers go up every year - in 2026, they’ll be $10,600 and $21,200. This cap isn’t just a nice perk. It’s a legal requirement under the Affordable Care Act. Before 2014, insurers could make you pay for every doctor visit and prescription without it counting toward anything. People with chronic conditions - like diabetes or high blood pressure - could spend thousands a year just to keep their meds, and still owe thousands more for hospital care. The ACA changed that. Now, every dollar you pay in copays, coinsurance, or toward your deductible counts toward your out-of-pocket maximum. That’s the safety net.Generic copays don’t count toward your deductible - here’s why

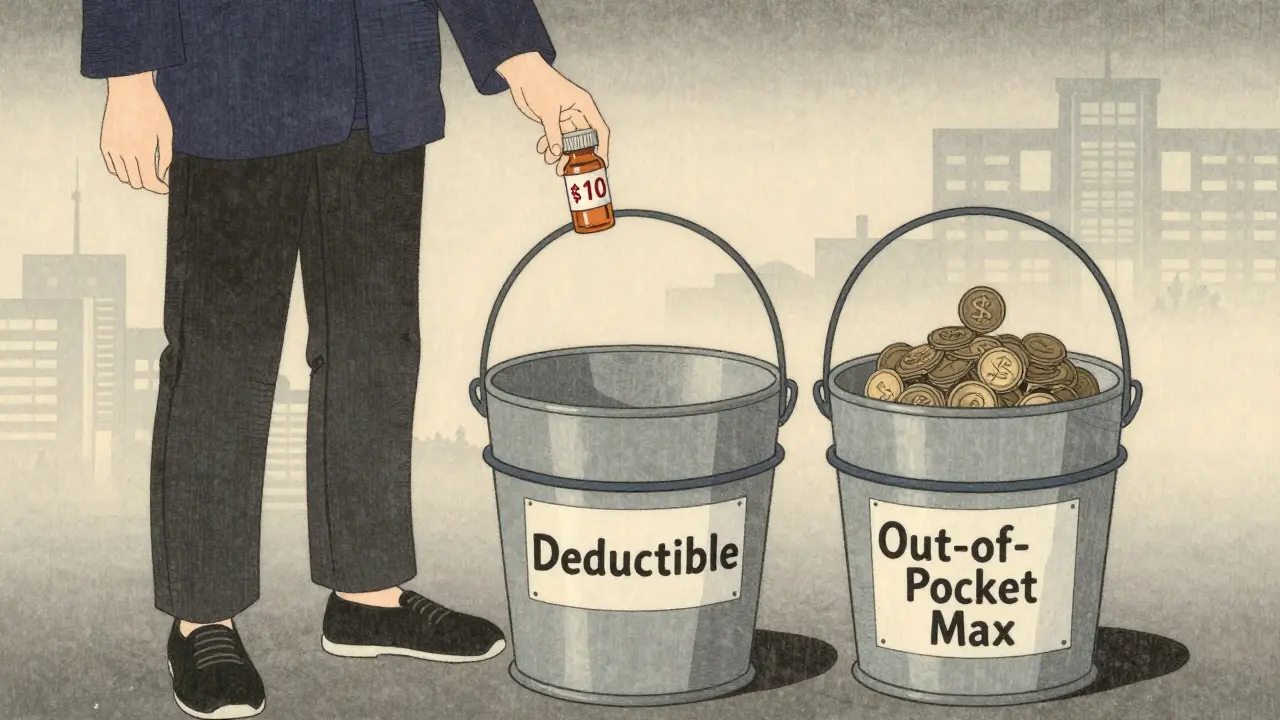

Here’s the twist: even though your $10 generic prescription copay counts toward your out-of-pocket maximum, it usually doesn’t count toward your deductible. That’s not a mistake. It’s how most plans are designed. Think of it like two separate buckets. One is your deductible - the amount you pay before your insurance starts sharing costs for doctor visits and hospital stays. The other is your out-of-pocket maximum - the total you’ll pay in a year for everything: deductibles, copays, and coinsurance combined. If your plan has a $1,500 medical deductible and $10 generic copays, you pay $10 every time you fill a prescription - even before you’ve met your deductible. But those $10 payments don’t reduce your $1,500 deductible. They only add up toward your out-of-pocket maximum. So if you filled 100 prescriptions at $10 each, you’d pay $1,000 - but your deductible is still $1,500. You’re $500 away from meeting it, even though you’ve already paid $1,000. This structure exists because insurers want to encourage you to use preventive care and low-cost generics without triggering your deductible too early. But it also creates confusion. A 2023 survey found 68% of people think copays reduce their deductible. They don’t. And that misunderstanding leads people to skip meds they need, thinking they’ve already paid enough.Three plan types - and how they handle prescriptions

Not all plans work the same way. There are three main models:- Single deductible (27% of plans): Your medical and prescription costs count toward one combined deductible. Once you hit it, you pay coinsurance for everything. No separate copays for prescriptions - you pay a percentage of the drug cost instead.

- Separate deductibles (37% of plans): You have one deductible for doctor visits and hospital care, and another for prescriptions. You might pay full price for meds until you hit the prescription deductible, then pay a copay. Those copays count toward your out-of-pocket maximum, but not your medical deductible.

- Copay-only (36% of plans): No prescription deductible at all. You pay your $10, $20, or $45 copay right away - no waiting. But again, those payments don’t reduce your medical deductible. They only count toward your out-of-pocket maximum.

How to find out how your plan works

You can’t guess. You have to check. Every plan must give you a Summary of Benefits and Coverage (SBC) before you enroll. Look for this section:- “Does this payment count toward my deductible?” - This is the key question. If it says “No” for copays, then your copays aren’t helping your deductible.

- “What is my out-of-pocket maximum?” - Make sure you know the number.

- “Are there separate deductibles for prescriptions?” - If yes, you’ll pay full price until you hit that number.

Real stories: What happens when people get it wrong

One user on HealthCare.gov’s forum said she paid $10 copays for her blood pressure meds all year - $1,200 total. She thought she’d met her $2,000 deductible. When she went to the hospital for a flare-up, she was hit with a $1,500 bill because she hadn’t met it. She’d paid $1,200 in copays, but none of it counted. Another person on Reddit said they stopped filling their asthma inhaler because they thought they’d already paid enough. They ended up in the ER. Their out-of-pocket maximum was $6,000, but they’d only paid $800 because they didn’t know copays didn’t count toward their deductible. On the flip side, people with chronic conditions now benefit. A diabetes patient shared that last year, after paying $8,500 in copays and coinsurance, their out-of-pocket maximum was reached. For the rest of the year, their insulin was free. That wouldn’t have happened before 2014.What’s changing in 2025 and beyond

The government is trying to fix the confusion. Starting in 2025, insurers must make it clearer on bills and statements whether a payment counts toward your deductible or just your out-of-pocket maximum. You’ll see labels like “Counts toward OOP max: Yes” or “Counts toward deductible: No.” Some insurers are testing new models. In five states, a pilot program lets prescription copays count toward a single, combined deductible. Early results show patients take their meds 28% more often. That’s huge - underuse of prescriptions costs the system $15 billion a year in avoidable hospital visits. Analysts predict that by 2027, 60% of major insurers will offer at least one plan where generic copays count toward the deductible. Why? Because people are tired of the complexity. But insurers warn that simplifying this could raise premiums by 3-5% - because they’d lose the ability to shift costs to the front end.What you should do right now

1. Find your SBC document. Log into your insurer’s portal or call them. Ask for the Summary of Benefits and Coverage for your current plan. 2. Look for the “Deductible” and “Out-of-Pocket Maximum” sections. Check whether copays count toward the deductible. If it says “No,” you know. 3. Add up your copays from the last year. If you paid $2,000 in copays and still haven’t met your $1,500 deductible, you’re not alone. That’s normal - but now you know why. 4. Plan ahead. If you’re on a plan with a separate prescription deductible, save money for the first few months of the year. You’ll pay full price until you hit that number. 5. Ask questions during open enrollment. When you pick your plan next year, don’t just pick the lowest premium. Ask: “Do generic copays count toward my deductible?” If the answer isn’t clear, walk away.Bottom line: Know your plan, not your assumptions

Generic copays are a lifeline for people on chronic meds. But they’re not magic. They don’t erase your deductible. They only help you hit your out-of-pocket maximum - which is still a huge win. The system isn’t perfect. It’s confusing. But now you know how it works. And that knowledge can save you thousands.Next time you pay your $10 copay, remember: you’re not getting closer to your deductible. But you are getting closer to the day your insurance pays for everything. That’s the real goal.

9 Comments

Bro I just paid $120 for my insulin last month and thought I was halfway to my deductible. Turns out I’ve been throwing cash into a black hole. No wonder I got hit with a $2k bill for a simple ER trip. This post is a godsend. Why isn’t this taught in high school? 🤯

It is, in fact, a lamentable manifestation of regulatory obfuscation that the American healthcare system has institutionalized such cognitive dissonance in its financial architecture. The conflation of out-of-pocket maximums with deductibles constitutes a fundamental breach of transparency, and one which, I submit, ought to be addressed by legislative fiat rather than reliance upon consumer diligence.

i just realized i paid $800 in copays last year and still had to pay $1200 for my knee physical therapy because i thought i was 'done' with paying lol my insurance never told me this and i feel so dumb but also like why dont they just say it in big letters on the bill like DUDE YOUR COPAYS DONT COUNT TOWARD YOUR DEDUCTIBLE THEY JUST HELP YOU GET TO THE OOP MAX

So the system is designed to confuse people into skipping meds? That’s not a bug, that’s a feature. I’m not surprised. We’re basically being gaslit by our own insurance providers. But hey, at least we get to feel like we’re ‘saving money’ on the front end while getting wrecked later. Classic.

This is all part of the Great Healthcare Scam™. The ACA didn’t fix anything-it just made the paperwork prettier. They want you to think you’re protected, but really, they’re just moving the goalposts. And don’t get me started on how ‘Summary of Benefits’ is written in 12-point font with invisible ink. They don’t want you to understand. They want you to pay.

yo i just checked my SBC and it says ‘Counts toward deductible: No’ for my asthma inhaler 😭 i’ve been paying $15 every 30 days for 10 months. that’s $450 gone. my deductible is still $1500 away. i feel like a sucker. 🥲

OMG I JUST REALIZED I’M NOT ALONE!! 😭 I thought I was doing everything right-taking my meds, staying on top of it-and then BAM, $1800 hospital bill. I’m so glad this post exists. Thank you for explaining it like I’m not a financial wizard. 🙏❤️

Consider the epistemological dissonance inherent in the structural design of modern health insurance: the bifurcation of financial responsibility into two parallel, non-intersecting fiscal vectors-the deductible and the OOP maximum-creates a phenomenological illusion of progress toward financial relief, when in fact, only the latter serves as a true fiscal anchor. The former, a mere artifact of actuarial optimization, functions as a psychological deterrent to adherence, thereby perpetuating systemic underutilization of preventive care-a paradox of incentivized neglect.

Found my SBC. Copays don’t count toward deductible. Just OOP max. I’m going to start budgeting for the first few months of next year like I’m preparing for a hurricane. Knowledge is power. Thanks for the clarity.