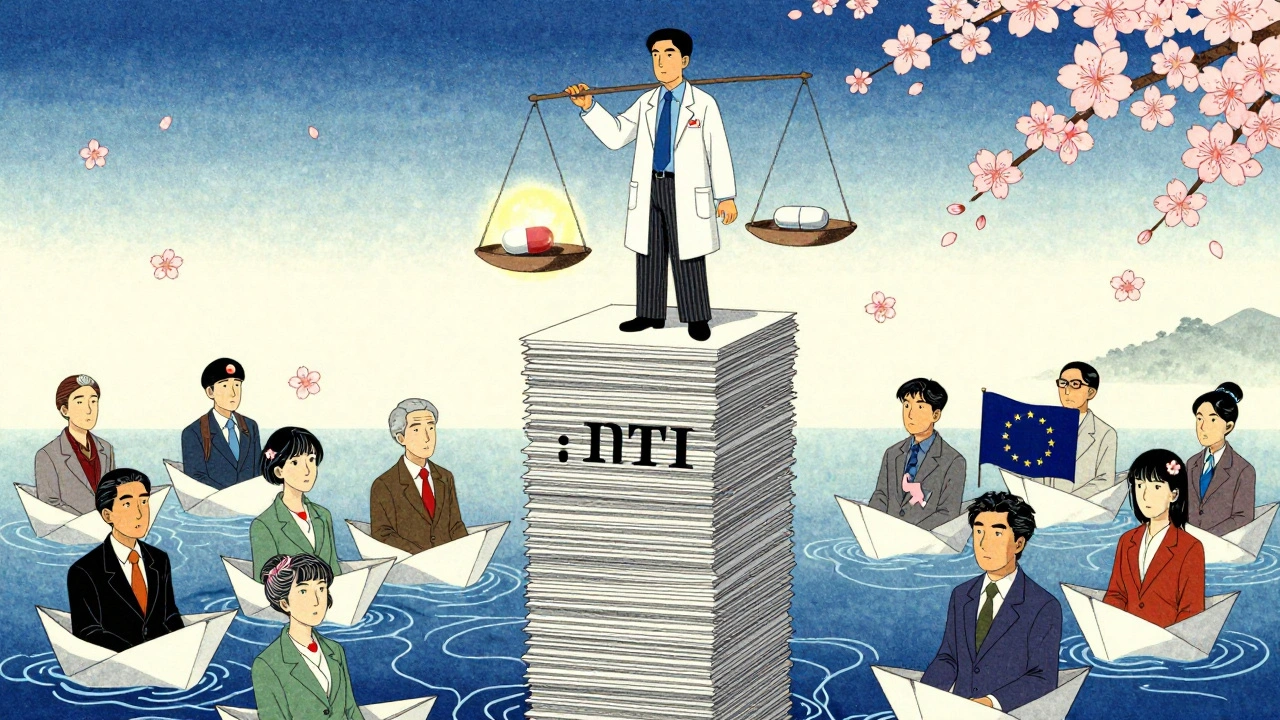

When a drug has a narow therapeutic index, even a tiny change in dose can mean the difference between healing and harm. That’s why NTI generics - the cheaper versions of drugs like warfarin, phenytoin, and levothyroxine - aren’t treated like ordinary generics. In the U.S., the FDA requires tighter quality controls and stricter bioequivalence standards. In Europe, regulators use multiple approval paths with varying rules across countries. And in Japan and Canada, the approach leans on detailed dissolution profiles and foreign reference products. The result? A global patchwork of rules that can confuse doctors, pharmacists, and patients alike.

What Makes NTI Drugs So Sensitive?

Narrow Therapeutic Index (NTI) drugs have a razor-thin margin between the dose that works and the dose that causes harm. Take warfarin, for example. A 10% change in blood concentration can lead to dangerous bleeding or a clot. Phenytoin, used for seizures, can trigger toxicity if levels creep just a little too high. Levothyroxine, for thyroid replacement, needs to be precise - too little and symptoms return, too much and the heart races. These aren’t drugs you want to gamble with.

The FDA defines NTI drugs as those where small changes in blood concentration can cause serious therapeutic failures or adverse reactions. That’s why regulators don’t treat them like regular generics. While most generics must show bioequivalence within an 80-125% range, NTI generics often need to fall within tighter limits - sometimes as narrow as 90-111%. The FDA also tightens the quality assay range from 90-110% to 95-105%. That means the active ingredient must be more consistent from pill to pill.

How the FDA Regulates NTI Generics in the U.S.

The U.S. Food and Drug Administration has been leading the charge on stricter NTI standards since 2010, when it released specific guidance for drugs like warfarin. Since then, the FDA has required NTI generics to meet more rigorous bioequivalence criteria. Healthy volunteers are preferred in studies - not patients - to eliminate variables like metabolism differences caused by illness. The goal is to compare the drug formulation, not the patient’s body.

But even with these rules, problems persist. A 2023 FDA report showed NTI generic applications had a 22% higher rejection rate than non-NTI ones. Most rejections were due to bioequivalence issues - the drug didn’t behave the same way in the body as the brand. In 2023, the FDA rolled out GDUFA III, which adds new post-market surveillance requirements for NTI drugs. That means companies must track real-world outcomes after approval, not just lab results.

State-level rules add another layer. Twenty-six U.S. states have special laws for NTI substitution. North Carolina requires both doctor and patient consent before switching. Connecticut, Idaho, and Illinois demand extra notifications for anti-seizure drugs. Pharmacists report that 67% of U.S. prescribers ask them to avoid substituting NTI generics - especially for levothyroxine and warfarin. One pharmacist on Reddit shared three cases this year where patients’ thyroid levels shifted after switching generics, even though the FDA called them equivalent.

The European Approach: Fragmented but Strict

The European Medicines Agency (EMA) doesn’t have one single rulebook for NTI generics. Instead, it offers three pathways: the Centralized Procedure, the National Procedure, and the Decentralized/Mutual Recognition route. The Centralized Procedure - which takes about 210 days - is the most thorough and results in approval across all EU countries. But only 68% of new generic applications used this route in 2022, up from 42% in 2018. Most companies still choose national routes, which can vary wildly between Germany, France, and Spain.

Spain is a standout example. When a brand-name drug loses exclusivity, the first generic must price at least 40% lower. Subsequent generics must match or undercut that price. This drives fierce competition - but also raises concerns about quality. In contrast, Germany and Denmark don’t impose strict price controls, allowing more flexibility in pricing and supply.

European pharmacists report confusion too. A 2022 survey by the European Association of Hospital Pharmacists found that 58% struggled with substitution rules across countries. Why? Because a generic approved under the Decentralized Procedure in one country might not meet the same standards as one approved nationally in another. The EMA is pushing for more use of the Centralized Procedure to reduce this inconsistency.

Canada, Japan, and Other Regional Models

Canada has taken a pragmatic route. It allows generic manufacturers to use foreign reference products - like the U.S. or EU brand - if they prove identical formulation, solubility, and physicochemical properties. They also require multi-point dissolution testing, which shows how the drug releases over time. This helps catch differences in modified-release formulations, which are especially tricky for NTI drugs.

Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) has detailed guidance for topical NTI drugs, including specific dissolution testing protocols. The U.S. has over 100 such drug-specific guidances since 2007, while many other countries, including Brazil and Mexico, have little to no public guidance for NTI generics.

These differences matter. Only four major regulators - the U.S., EU, Japan, and Canada - have formal, published standards for NTI bioequivalence. For the rest of the world, approval often relies on incomplete data or assumptions. That’s why the International Generic Drug Regulators Pilot (IGDRP), launched in 2012, exists. It brings together regulators from the U.S., EU, Canada, Japan, South Korea, Singapore, Switzerland, and Taiwan to align methods and reduce duplication.

Cost, Time, and the Burden on Manufacturers

Developing an NTI generic isn’t cheap or quick. It takes 18 to 24 months and costs $5-7 million - nearly double the time and money needed for a standard generic. Why? Because companies must run more complex bioequivalence studies, perform stress testing on packaging, and model long-term stability. One regulatory affairs executive at Accord Healthcare said they’ve seen applications rejected because a tablet dissolved 5% slower than the brand - a tiny difference, but enough to fail NTI standards.

Modified-release NTI drugs - like extended-release phenytoin - are the hardest. They account for 23% of the NTI market but face the most regulatory hurdles. Only a handful of countries have clear guidance for them. That’s why many companies now engage with regulators early - through FDA’s Complex Generic Drug Product Development Meetings or EMA’s Scientific Advice - to avoid costly rejections. These consultations can shave 30-45 days off approval time.

Market Growth and Who’s Leading

Despite the hurdles, the NTI generics market is growing fast. It was worth $48.7 billion in 2022 and is projected to hit $72.3 billion by 2027. The U.S. leads with 42% of global sales, followed by Europe at 34%. Teva dominates the market with nearly 19% share, followed by Mylan, Sandoz, and Hikma.

But adoption varies. Warfarin generics have 92% market penetration in the U.S. - doctors and patients trust them. Levothyroxine? Only 67%. That gap shows the lingering fear among prescribers. Even when studies prove equivalence - like the 2021 IMS Institute study showing 94.7% success in 12,500 European patients - skepticism remains.

What’s Next? Harmonization and New Methods

The future of NTI generics lies in better science and more cooperation. In 2023, the ICH adopted the M9 guideline, which allows certain drugs to skip bioequivalence studies based on their solubility and permeability - a potential game-changer for some NTI drugs. The FDA is also planning to adopt population bioequivalence methods by 2025, moving beyond single-subject studies to look at how groups respond. This could make testing more accurate and less expensive.

Experts like Dr. Jessica Greene predict international collaboration through the IGDRP could cut approval times by 25-30% over the next decade. But harmonization won’t come easily. The U.S. prioritizes strict, science-based controls. Europe balances price pressure with quality. Canada values flexibility. Japan demands precision. Finding common ground is hard - but necessary.

For now, patients, doctors, and pharmacists must navigate this complex system. The science is there. The data shows NTI generics can be safe and effective - when they meet the right standards. The challenge isn’t just regulatory. It’s trust.

What drugs are considered narrow therapeutic index (NTI) drugs?

Common NTI drugs include warfarin (a blood thinner), phenytoin (an anti-seizure medication), levothyroxine (for thyroid replacement), digoxin (for heart conditions), and lithium (for bipolar disorder). These drugs have a very small window between an effective dose and a toxic one. Even minor changes in blood levels can lead to serious side effects or treatment failure.

Why are NTI generics harder to approve than regular generics?

Because small differences in how the drug is absorbed or released can lead to dangerous outcomes, regulators require tighter bioequivalence standards. While regular generics must match the brand within 80-125%, NTI generics often need to fall within 90-111% or even tighter. The FDA also requires stricter quality control - 95-105% active ingredient content instead of 90-110%. Studies must use healthy volunteers to isolate formulation effects, and dissolution testing must be more detailed.

Do all countries regulate NTI generics the same way?

No. The U.S. and EU have the most detailed standards, but even within the EU, rules vary by country. Canada allows foreign reference products if they’re identical. Japan has specific guidance for topical NTI drugs. Many countries, including Brazil and Mexico, lack formal guidance. The International Generic Drug Regulators Pilot (IGDRP) is working to align these approaches, but full harmonization is still years away.

Can NTI generics be safely substituted for brand-name drugs?

Yes - when they meet strict regulatory standards. A 2021 study of 12,500 patients across 15 European countries found 94.7% had equivalent clinical outcomes with properly approved NTI generics. But in the U.S., many doctors still avoid substitution due to past issues and state laws. The key is ensuring the generic meets the tighter bioequivalence and quality controls required for NTI drugs.

Why do pharmacists get so many requests to avoid substituting NTI generics?

Because of real-world concerns. A 2019 survey found 67% of U.S. pharmacists received requests from doctors not to substitute NTI generics, especially for levothyroxine and warfarin. Some patients have experienced fluctuations in blood levels after switching, even when the FDA approved the generic. While studies show most substitutions are safe, the fear of harm - and legal liability - makes many prescribers cautious.

What’s being done to improve NTI generic regulation globally?

The ICH M9 guideline (2023) allows some NTI drugs to skip bioequivalence studies based on their properties. The FDA is moving toward population bioequivalence methods by 2025, which use data from groups instead of individuals. The EMA is pushing more companies to use its Centralized Procedure. And the IGDRP - a collaboration between regulators from the U.S., EU, Canada, Japan, and others - is working to align testing standards and reduce duplication. These steps aim to make approvals faster, cheaper, and safer.

15 Comments

It's wild how the same drug can be treated like a precision instrument in one country and a commodity in another. I've seen pharmacists in Dublin hesitate to swap levothyroxine brands even when FDA-approved - not because they doubt the science, but because they’ve seen patients panic over tiny TSH shifts. Trust isn’t built in labs, it’s built in waiting rooms.

Maybe the real issue isn’t regulation - it’s communication. Doctors don’t need more guidelines. They need a simple, consistent way to explain to patients why switching isn’t just ‘same pill, cheaper price.’

As someone who has spent years navigating both the U.S. and EU regulatory landscapes, I find the disparity in NTI generic standards not just frustrating - it’s ethically untenable. The FDA’s 95–105% assay range is not arbitrary; it’s the product of decades of clinical data showing that even 2% variability in levothyroxine can precipitate atrial fibrillation in elderly patients.

Meanwhile, in some EU member states, generics are approved based on dissolution profiles from 1990s reference products. This isn’t harmonization - it’s regulatory colonialism disguised as cost-efficiency.

And yet, the pharmaceutical industry continues to exploit this fragmentation, cherry-picking jurisdictions with the weakest standards. We must demand transparency - not just in bioequivalence, but in the entire supply chain.

From India, we see this every day - cheap generics flood the market, but nobody talks about the real cost: patients who get sick because the pill dissolved too slow or too fast. I work in a hospital pharmacy and we avoid NTI swaps unless we’ve tested the batch ourselves. It’s not about distrust - it’s about survival.

One guy came in with tremors after switching to a new phenytoin brand. His level was 19.8 mcg/mL. Normal is 10–20. He was *on the edge*. The generic was ‘approved’ - but the dissolution curve was all wrong.

We need global standards. Not because it’s fair - because people are dying from paperwork.

Let’s cut through the jargon: NTI generics aren’t ‘harder to approve’ - they’re harder to *fake*. The FDA isn’t being difficult - they’re being responsible. Companies want to slap a ‘generic’ label on a pill that dissolves 10% slower and call it ‘equivalent.’ No. That’s not equivalence. That’s negligence wrapped in a patent expiration.

And don’t get me started on the ‘cost’ argument. If you’re spending $7 million to make a drug that doesn’t kill people, that’s not a cost - that’s an investment in human life. Stop pretending this is about price. It’s about accountability.

Pathetic. The FDA’s standards are a joke. You think 90-111% is tight? Try 98-102%. That’s what real science looks like. All this ‘bioequivalence’ nonsense is just corporate lobbying dressed up as regulation. Why do we even need healthy volunteers? Real patients have comorbidities. Real people take other meds. Testing on ‘healthy’ people is like testing a parachute on a mannequin.

And don’t get me started on Canada letting them use foreign references. That’s not science - that’s regulatory arbitrage. The whole system is rigged for profit, not patients.

Oh wow, look at this - a 22% rejection rate for NTI generics? Shocking! Who knew that making a drug that doesn’t kill people is so hard? And here I thought the FDA was just being overly cautious. I mean, who cares if a pill dissolves 5% slower? It’s still the same chemical. Maybe we should just let pharmacists decide - after all, they’re the ones who know what’s best for patients. /s

Also, why are we even talking about this? The real problem is that people can’t afford brand-name drugs. Let’s just print more generics and call it a day. Science? Who needs it?

There is a quiet revolution happening in NTI generics - and it’s not in the labs. It’s in the pharmacy counter.

I’ve been a hospital pharmacist for 27 years. I’ve seen patients on warfarin for decades. I’ve watched their INRs stabilize - then spike after a generic switch. Not because the pill was bad. Because the *expectation* changed. The patient, the doctor, the nurse - they all feel it. The doubt.

Regulation can mandate equivalence. But only trust can guarantee safety. And trust? It’s built one conversation at a time. Not one guideline.

Just a quick note from a clinical pharmacist: I recently had a 72-year-old woman come in with palpitations after switching levothyroxine brands. Her TSH was 8.4. Normal range: 0.4–4.0. She was fine on the brand. The generic? FDA-approved. Same active ingredient. But the fillers? Different. The coating? Different. The dissolution? Slower.

We switched her back. Her TSH dropped to 1.9 in 3 weeks.

So yes - the science says ‘equivalent.’ But the patient? She says ‘I feel like a different person.’ And sometimes, that’s the only data that matters.

NTI generics are overregulated. The FDA’s standards are excessive. Most patients don’t notice a difference. Stop wasting money on complex studies. Just let the market decide.

Also, why do we even need dissolution profiles? Just check the label. Done.

Let’s talk about the elephant in the room: the IGDRP is a noble idea - but it’s been running for 12 years and still hasn’t created a single binding standard. Meanwhile, patients in low-income countries are getting generics that haven’t been tested for bioequivalence at all. The U.S. and EU are playing chess while the rest of the world is playing Jenga with their lives.

And yet, we still call this ‘global health equity.’ What a joke.

We need a WHO-led, mandatory NTI framework - not another pilot program. Real change, not more meetings.

in india we have so many ntis generics and no one really check them. i saw a patient who switched to a new warfarin generic and got a brain bleed. the pharmacy said it was 'same as brand'. but the tablet looked different. no one tested it. no one cared.

we need better testing. not more papers. real labs. real data. not just 'approved' stamps.

There’s a deeper truth here: we treat NTI drugs like they’re fragile, but we treat the people who take them like they’re interchangeable.

It’s not about whether the pill dissolves in 20 or 25 minutes. It’s about whether the system trusts the patient enough to tell them: ‘This change might affect you. Let’s be careful.’

Maybe the solution isn’t more regulation - it’s more respect.

Oh, so the FDA’s 95–105% range is ‘science’ - but when Germany allows a 90–110% range, it’s ‘corporate greed’? How convenient.

Let’s be real: this whole debate is theater. The real issue is that brand-name companies are scared of losing market share. So they lobby for ‘tighter standards’ to block generics - then turn around and charge $1,200 a month for the same damn pill.

The FDA isn’t protecting patients. It’s protecting profits - just with a lab coat.

I come from a family where my grandmother took levothyroxine for 30 years. She never switched brands. Not because she didn’t want to save money - but because she was terrified. She’d wake up at 3 a.m. checking her pulse. She’d call the pharmacy if the pill looked different.

And you know what? She was right to be scared. Because no one ever told her the truth: ‘It’s the same.’

So we keep telling her it’s safe - but we never fix the system that made her afraid in the first place.

Okay, I’ve been reading this whole thing and I’m just sitting here with my coffee, tears in my eyes, because this isn’t just about pills - it’s about dignity.

Imagine being told your life depends on a tiny white tablet - and then, without warning, you get a different one. Same name. Same dose. But the color’s off. The shape’s different. Your doctor says it’s ‘equivalent.’ But your body? Your body knows.

And now you’re terrified to sleep. To eat. To trust anyone. Not because the science is wrong - but because the system made you feel like a lab rat.

We need to stop treating patients like data points and start treating them like humans who’ve lived with this for decades.

Also - can we PLEASE make the generic packaging look the same? It’s not about branding. It’s about peace of mind. 😔💊